Thursday, 20 June 2024

How to Position for the Next Phase of the Lion Mining Clock

by BD Banks

An old colleague of mine used to say there are real estate people…and stock market people.

What he meant is that the two groups act as if each is separate from the other.

But it’s not true.

That’s why it pays to pay attention to what’s happening in BOTH markets.

Yes…I know. More work. More hassle. More investigating.

It’s also why I found myself sitting in the RACV club in Melbourne last week.

Admittedly, it was rather nice. I put on my best jacket. There was a lovely entrée too.

I kept to the spring water though.

I wasn’t there to feast like a Greek god. I was listening to commercial property king Warren Ebert.

Warren is as sharp as a tack. That’s why he runs a property funds business with $2 billion under management, called Sentinel Property Group.

Warren is buying up as many properties in North Queensland as he can get his hands on.

He made the point that a good chunk of people in QLD make Sydney wages, but have lower housing costs. That leaves them with more discretionary income.

That’s money they can spend in his shopping centres. That keeps his tenants happy and profitable. And delivers him a tidy stream of rents.

Smart man, that Warren.

But…why is North Queensland the place to be?

One reason – and this is a big one – is mining.

You only need to look at a map to see the Sunshine State is huge. There’s coal, gold, gas, copper – you name it, QLD’s probably got it.

That means high wages for the QLD regions. Warren is tapping into this wealth via the property market.

We can do the same thing in the share market.

I’ve made the case for small cap shares many times here in Fat Tail Daily.

But which small cap shares? God knows there’s a lot of them.

One sector increasingly looking like a slam dunk is small cap resource stocks.

The team at Firetrail did some sleuthing here. Look at what they discovered…

‘Our analysis from earlier this year illustrated that the 3-year earnings growth outlook for resources would be the major driver of the Small Ords 3-year earnings growth…

‘For those wanting to invest in small caps to participate in strong forecast earnings growth of ~15% per annum over the next 3 years (compared to just ~2.1% for the ASX100) it stands to reason that it is important to invest in the sectors of the small cap market that are delivering this growth.

‘This includes, most importantly, resources. Looking forward, we continue to see exciting opportunities in this space despite the recent rally.’

Indeed!

Now let’s follow through this line of thinking…

Our man Warren Ebert is buying up QLD property because he knows these assets will have a high, recurring and growing stream of rents underpinned from mining wages and profits.

So…who in the mining resource space is also thinking like this?

What I mean is that small resource companies are likely to become takeover targets as bigger firms swallow up their assets.

This is perfectly in accord with the current mining cycle.

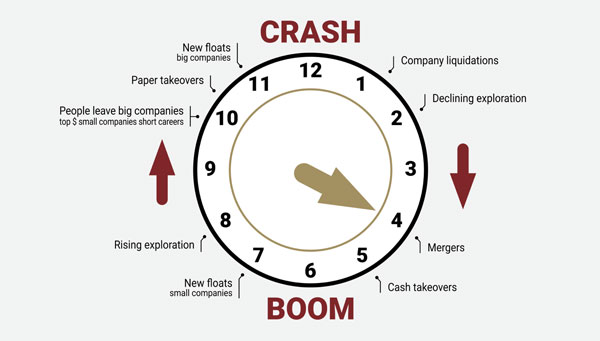

The Lion Investment Clock is one way to measure this. The team at Lion put us smack bang in the “mergers” phase now…moving toward cash takeovers.

See for yourself…

|

|

|

Source: Lion Selection Group |

I gave my readers one idea on this back in May: Spartan Resources [ASX: SPR].

Spartan is a gold explorer/developer.

What’s interesting here is that SPR is up about 20% since that recommendation went out even though the gold market is mixed in the same timeframe.

Why?

One reason is that Spartan has released some nice drilling results. Another is that fund managers are likely assessing it as a potential takeover target from a bigger gold company.

A little mining knowledge helps here. Many Aussie gold majors have tens of millions of cash on their books.

In other words, they’re cashed up like a bogan in Bali, and ready to party.

Care to learn more?

We have just released our much-anticipated report detailing why mining stocks from across the resources (and gold is a big one!) could be about to enter a cyclical bull market.

Increased merger activity is a tell-tale sign.

There are a number of other factors at play, though. They aren’t necessarily good for many industries, like utilities, airlines and infrastructure companies…but miners exploring for key commodities and the producers…well, see for yourself.

We have a playbook to go by too. An entire DECADE playbook.

See what I mean, right here.

Best,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

The post How to Position for the Next Phase of the Lion Mining Clock appeared first on Fat Tail Daily.